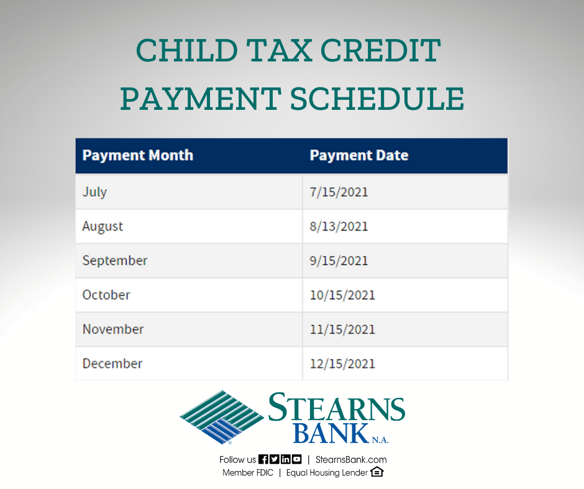

child tax credit 2021 dates

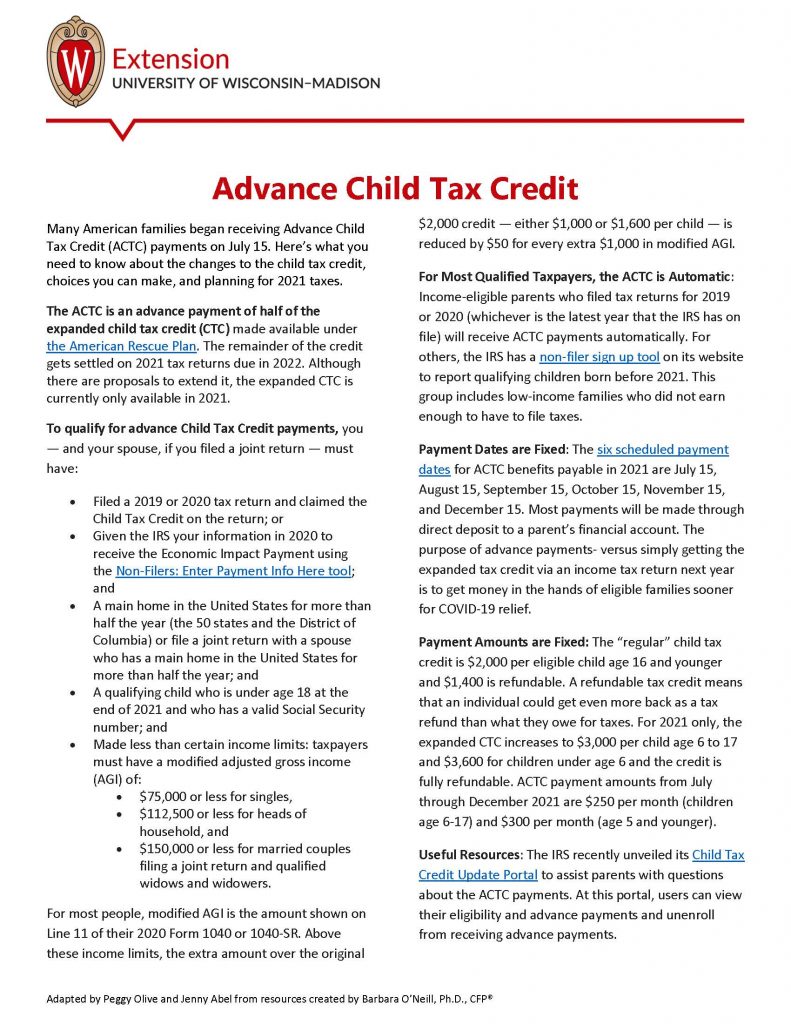

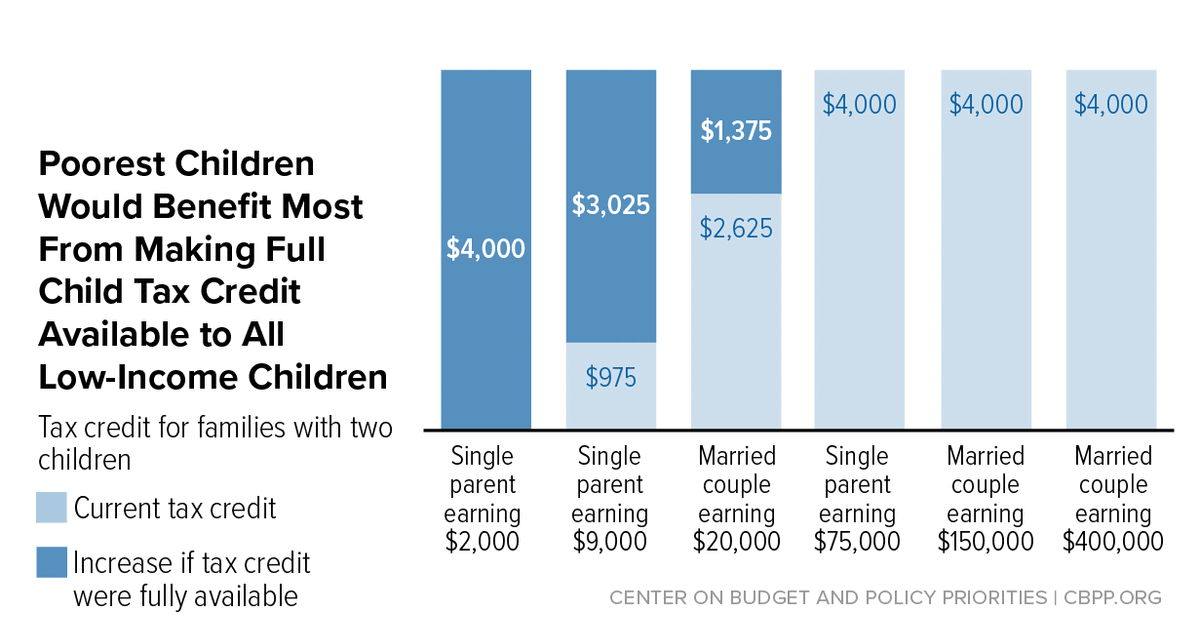

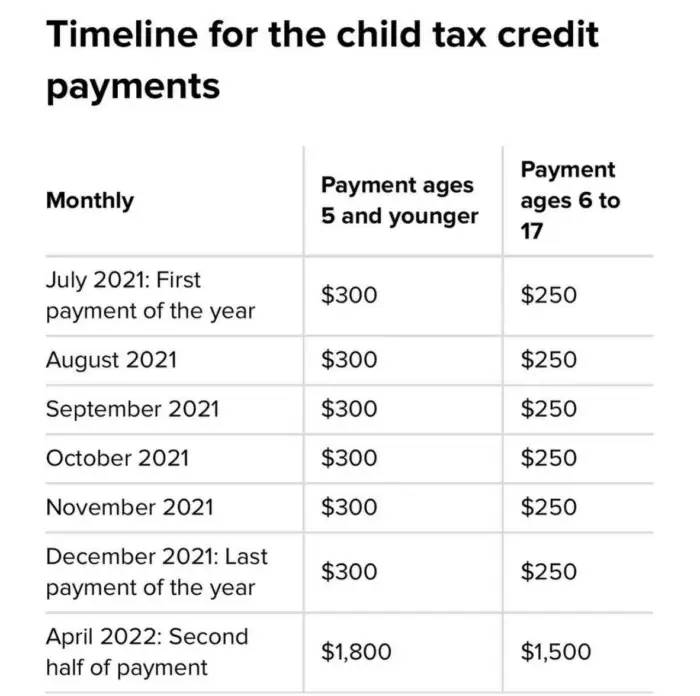

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250 per child.

Advance Child Tax Credit Payments Begin July 15

Child Tax Credit FAQs for Your 2021 Tax Return.

. All payment dates July 15 2022 includes retroactive amount for April 2022 October 14 2022. The Child Tax Credit is a payment that supported children and their families. To be a qualifying child for.

15 opt out by Aug. 3000 for children ages. 13 opt out by Aug.

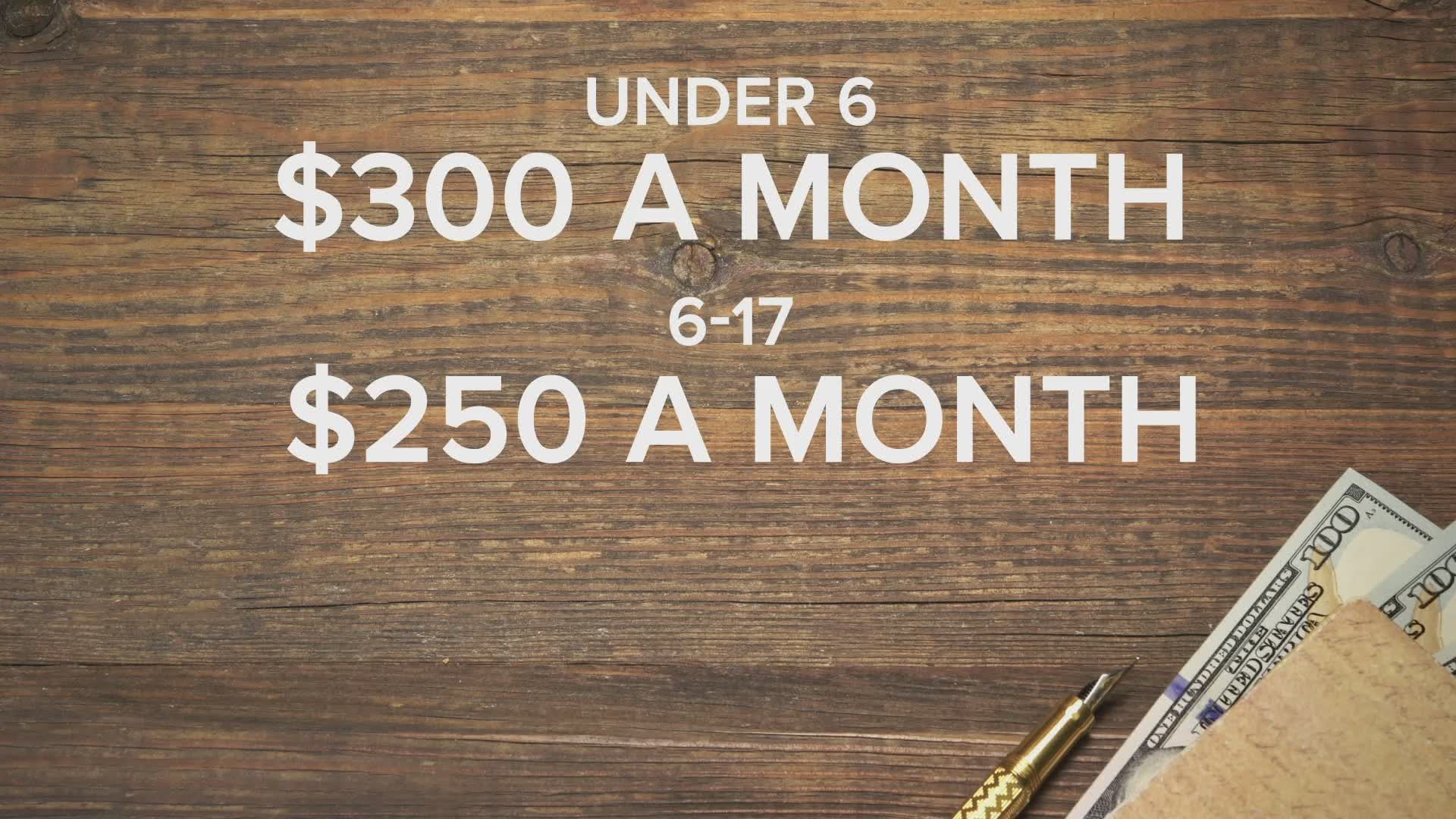

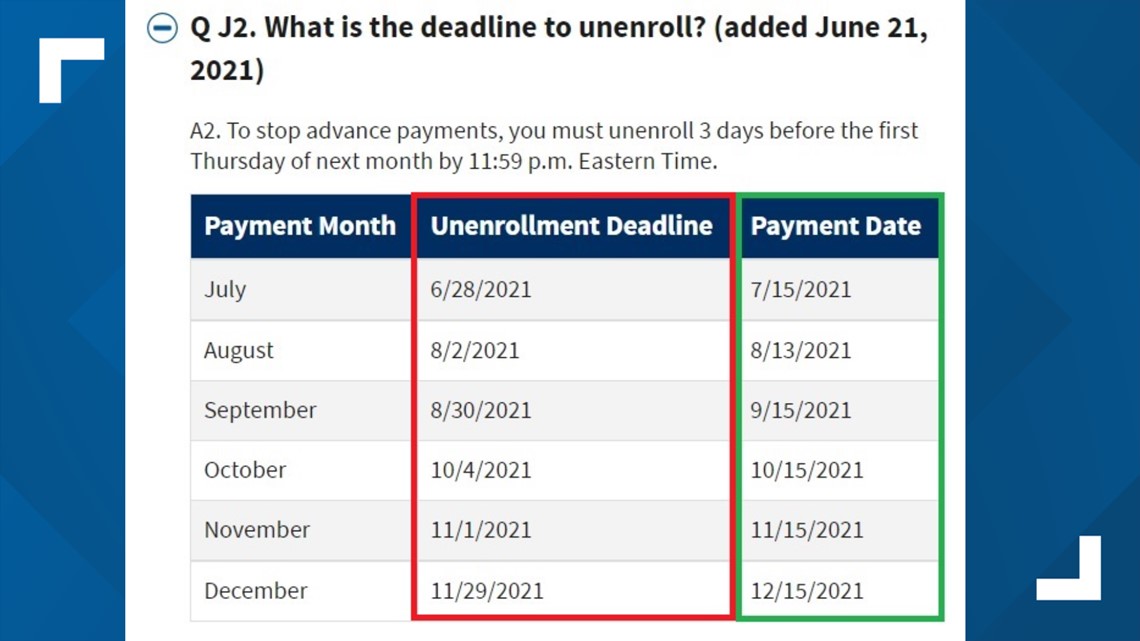

With the funds from Congress drying up the child poverty level will again go back to new highs. The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

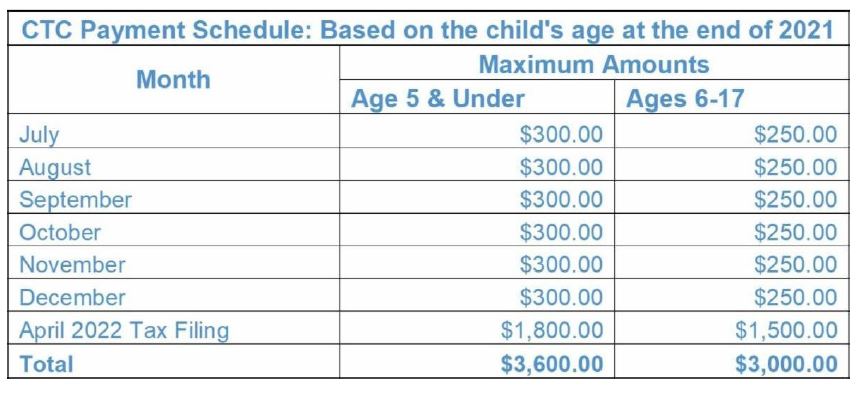

Under the American Rescue Plan the IRS disbursed. 3600 for children ages 5 and under at the end of 2021. New 2021 Child Tax Credit and advance payment details.

Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. Similarly for each child age 6 to 16 its increased from 2000 to 3000. The IRS said advance Child Tax Credit payments will be issue to those eligible from July 15.

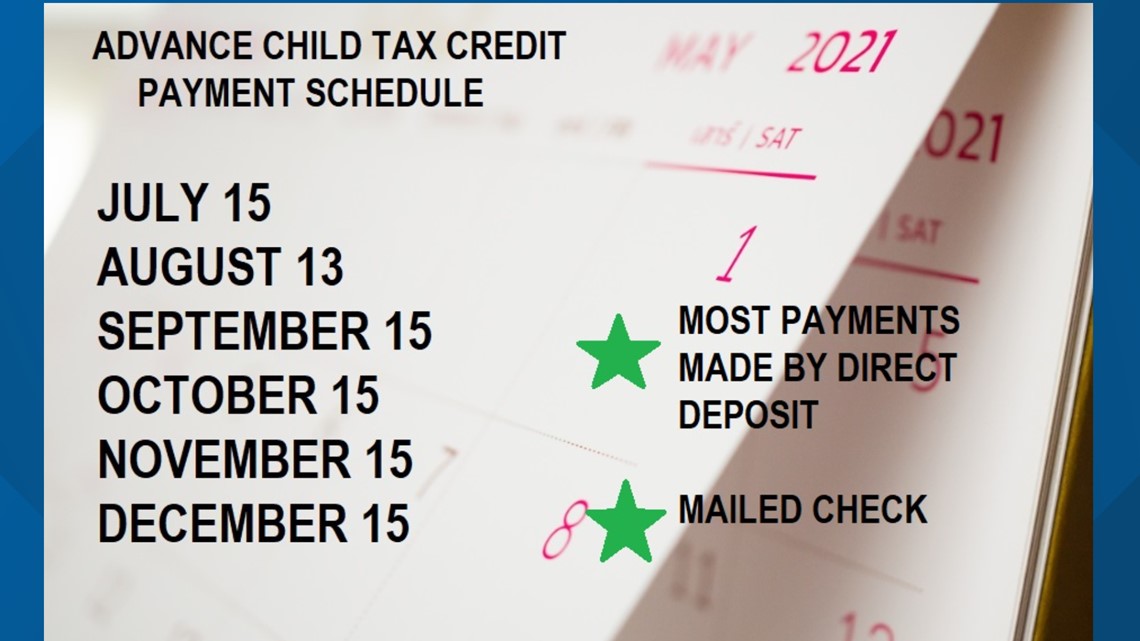

The payments will be made either by direct deposit or by paper check depending on what information the IRS has on file for each recipient. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for. Besides the July 15 payment payment.

Here are the child tax benefit pay dates for 2022. Your amount changes based on the age of your. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

That means another payment is coming in about a week on Oct. It also provides the 3000 credit for 17-year-olds. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Its usually around the 20th of the month but some dates are different for example December its a little earlier because of the. The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. If your payment is.

The Child Tax Credit offers 3000 to families with children aged between six and. The IRS pre-paid half the total credit amount in monthly payments from. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. 3 January - England and Northern Ireland only. Child Tax Credit amounts will be different for each family.

28 December - England and Scotland only.

Child Tax Credit Payment Begin In One Month July 15 Wfmynews2 Com

Child Tax Credit Payment Schedule Here S When To Expect Checks Ksdk Com

Advance Child Tax Credit Financial Education

The Deadline To Unenroll Or Opt Out Of The Child Tax Credit Wfmynews2 Com

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Check Advance Child Tax Credit Economic Impact Payments On 2021 Tax Returns

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

/cloudfront-us-east-1.images.arcpublishing.com/gray/PNCZCGZXXVB57LZHLUY5ZJ7BMM.jpg)

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

2021 Child Tax Credit Payment Calculator Smartasset

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Using The Child Tax Credit To Boost Your Banking

Advance Child Tax Credit Short Or Missing Navigate Housing

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com